All Categories

Featured

Table of Contents

One of the vital aspects of any insurance coverage plan is its cost. IUL policies frequently come with various charges and costs that can impact their overall worth.

Pay particular focus to the plan's features which will be vital depending upon just how you want to make use of the policy. Talk to an independent life insurance policy agent that can aid you select the best indexed universal life policy for your requirements.

Evaluation the plan carefully. If adequate, return signed distribution receipts to obtain your universal life insurance policy coverage effective. Make your very first costs settlement to activate your policy. Since we have actually covered the benefits of IUL, it's crucial to recognize exactly how it contrasts to other life insurance policy plans readily available on the market.

By comprehending the resemblances and distinctions between these plans, you can make a much more enlightened choice about which kind of life insurance policy is ideal suited for your requirements and economic objectives. We'll start by comparing index universal life with term life insurance coverage, which is usually taken into consideration one of the most uncomplicated and budget-friendly sort of life insurance.

How can I secure Flexible Premium Indexed Universal Life quickly?

While IUL might supply greater prospective returns due to its indexed cash money value development device, it likewise features higher premiums compared to term life insurance policy. Both IUL and entire life insurance policy are types of irreversible life insurance coverage policies that provide fatality benefit security and cash value growth possibilities (IUL for retirement income). There are some essential distinctions in between these two types of policies that are vital to think about when deciding which one is ideal for you.

When considering IUL vs. all other sorts of life insurance policy, it's crucial to weigh the pros and cons of each plan type and consult with a skilled life insurance representative or economic adviser to establish the very best alternative for your special demands and financial goals. While IUL supplies lots of advantages, it's likewise vital to be knowledgeable about the dangers and considerations connected with this type of life insurance policy plan.

Allow's delve deeper right into each of these threats. One of the key worries when taking into consideration an IUL policy is the numerous expenses and costs related to the policy. These can include the expense of insurance, policy fees, abandonment costs and any extra rider prices sustained if you include additional benefits to the plan.

Some might use extra competitive rates on coverage. Inspect the investment choices available. You desire an IUL policy with a variety of index fund selections to fulfill your needs. Make certain the life insurer lines up with your personal financial objectives, needs, and threat tolerance. An IUL plan should fit your certain situation.

What is High Cash Value Indexed Universal Life?

Indexed universal life insurance coverage can give a number of benefits for insurance holders, consisting of versatile costs settlements and the potential to make higher returns. The returns are limited by caps on gains, and there are no warranties on the market performance. All in all, IUL policies use several possible benefits, however it is important to recognize their threats.

Life is not worth it for most individuals. It has the possibility for huge financial investment gains however can be uncertain and pricey compared to typical investing. Additionally, returns on IUL are normally reduced with substantial charges and no assurances - Indexed Universal Life financial security. In general, it depends on your demands and objectives (IUL tax benefits). For those seeking predictable long-term savings and assured fatality advantages, entire life may be the much better alternative.

How can Indexed Universal Life Plans protect my family?

The benefits of an Indexed Universal Life (IUL) plan include potential higher returns, no downside risk from market movements, protection, flexible repayments, no age need, tax-free survivor benefit, and finance schedule. An IUL plan is irreversible and offers money value development via an equity index account. Universal life insurance coverage began in 1979 in the United States of America.

By the end of 1983, all major American life insurance firms offered universal life insurance coverage. In 1997, the life insurance company, Transamerica, introduced indexed global life insurance policy which gave insurance holders the capacity to link plan development with worldwide securities market returns. Today, universal life, or UL as it is likewise understood can be found in a range of various types and is a significant part of the life insurance policy market.

The information given in this short article is for educational and educational objectives only and should not be construed as financial or investment suggestions. While the writer possesses know-how in the subject matter, viewers are advised to seek advice from a certified monetary advisor before making any financial investment decisions or purchasing any type of life insurance policy items.

How do I compare Indexed Universal Life Loan Options plans?

Actually, you may not have actually believed a lot regarding just how you desire to spend your retirement years, though you possibly know that you don't wish to run out of cash and you would love to keep your existing way of life. [video: Text appears next to the business man speaking to the camera that reads "company pension", "social security" and "savings".] < map wp-tag-video: Text appears alongside the organization man talking to the electronic camera that reads "firm pension", "social security" and "cost savings"./ wp-end-tag > In the past, individuals depended on three major income sources in their retirement: a business pension, Social Security and whatever they 'd taken care of to conserve

Fewer employers are offering typical pension. And several business have actually lowered or discontinued their retirement strategies. And your ability to count entirely on Social Safety and security is in question. Even if benefits have not been minimized by the time you retire, Social Protection alone was never ever planned to be adequate to pay for the lifestyle you want and deserve.

Prior to committing to indexed global life insurance policy, below are some benefits and drawbacks to think about. If you choose a good indexed universal life insurance strategy, you may see your money value grow in value. This is useful because you might have the ability to access this money before the strategy runs out.

How do I apply for Long-term Indexed Universal Life Benefits?

If you can access it early, it might be useful to factor it right into your. Since indexed global life insurance policy requires a specific level of danger, insurance provider tend to keep 6. This sort of strategy likewise supplies. It is still ensured, and you can readjust the face amount and cyclists over time7.

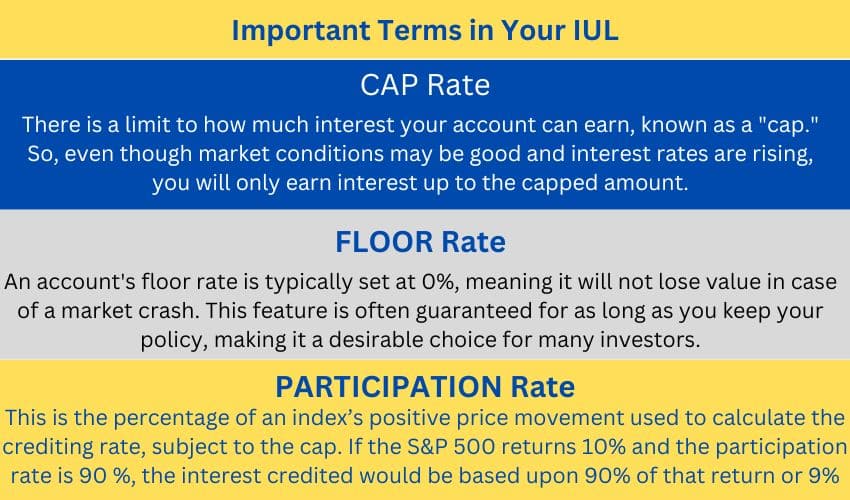

Last but not least, if the picked index does not carry out well, your money worth's development will be influenced. Commonly, the insurer has a vested interest in doing much better than the index11. There is usually an assured minimum rate of interest price, so your plan's development won't fall listed below a certain percentage12. These are all elements to be thought about when selecting the very best sort of life insurance policy for you.

Given that this type of policy is a lot more complex and has a financial investment component, it can typically come with higher costs than other policies like whole life or term life insurance policy. If you do not assume indexed universal life insurance policy is right for you, below are some options to think about: Term life insurance policy is a short-lived policy that generally provides insurance coverage for 10 to three decades

Latest Posts

Iul Retirement

My Universal Insurance

Fixed Indexed Universal Life Insurance Reviews